The Ultimate Guide To Transaction Advisory Services

Wiki Article

The Transaction Advisory Services PDFs

Table of ContentsExcitement About Transaction Advisory ServicesTransaction Advisory Services Fundamentals ExplainedTransaction Advisory Services for DummiesThe Best Strategy To Use For Transaction Advisory ServicesGetting The Transaction Advisory Services To Work

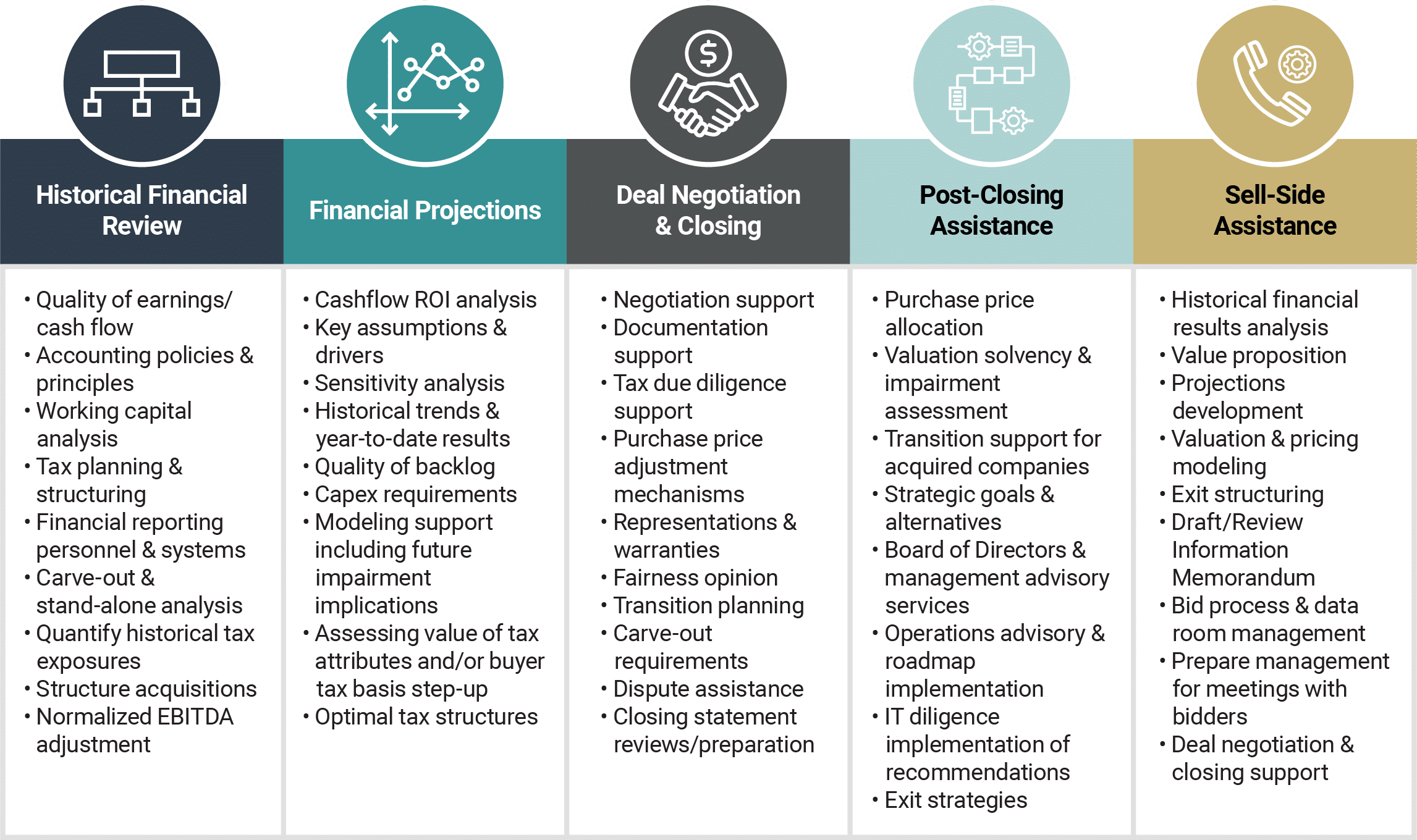

This step sees to it the service looks its finest to potential buyers. Getting the company's value right is vital for a successful sale. Advisors use different techniques, like reduced capital (DCF) evaluation, comparing with similar firms, and recent deals, to identify the reasonable market worth. This assists establish a reasonable cost and bargain efficiently with future buyers.Transaction experts step in to assist by getting all the required details organized, answering inquiries from buyers, and preparing brows through to the organization's location. Purchase experts use their know-how to aid organization proprietors handle difficult arrangements, satisfy buyer assumptions, and structure deals that match the owner's goals.

Meeting legal rules is vital in any type of company sale. Purchase advisory solutions function with lawful specialists to develop and evaluate agreements, arrangements, and other legal papers. This minimizes threats and makes certain the sale complies with the law. The function of deal experts expands past the sale. They assist entrepreneur in planning for their following steps, whether it's retired life, starting a new endeavor, or handling their newly found riches.

Deal advisors bring a riches of experience and knowledge, making sure that every element of the sale is handled professionally. With strategic preparation, appraisal, and arrangement, TAS helps entrepreneur attain the highest possible list price. By making sure legal and regulatory conformity and handling due persistance alongside other bargain employee, deal experts decrease prospective risks and responsibilities.

All About Transaction Advisory Services

By comparison, Large 4 TS teams: Service (e.g., when a potential customer is conducting due diligence, or when a bargain is closing and the customer requires to incorporate the business and re-value the vendor's Annual report). Are with charges that are not linked to the offer shutting effectively. Make costs per engagement somewhere in the, which is less than what financial investment financial institutions gain even on "little offers" (however the collection possibility is likewise a lot greater).

The meeting concerns are extremely comparable to financial investment banking meeting concerns, yet they'll concentrate much more on audit and assessment and much less on subjects like LBO modeling. For example, anticipate inquiries regarding what the Change in Working Funding ways, EBIT vs. EBITDA vs. Take-home pay, and "accounting professional only" subjects like trial equilibriums and just how to walk through events utilizing debits and debts as opposed to monetary statement adjustments.

Examine This Report on Transaction Advisory Services

Specialists in the TS/ FDD groups may additionally interview administration concerning whatever above, and they'll write an in-depth report with their searchings for at the end of the procedure., and the general form looks like this: The entry-level role, where you do a whole lot of data and monetary analysis (2 years for a promo from below). The following level up; comparable job, yet you obtain the more intriguing bits (3 years for a promo).

Particularly, it's challenging to get promoted past the Manager degree due to the fact that couple of individuals leave the task at that phase, and you need to start revealing evidence of your capacity to create earnings to advance. Let's start with the hours and way of living because those are less complicated to explain:. There are periodic late evenings and weekend job, but nothing like the agitated nature of financial investment financial.

There are cost-of-living changes, so expect lower compensation if you're in a less costly area outside significant monetary (Transaction Advisory Services). For all settings except Companion, the base pay makes up the bulk of the total settlement; the year-end benefit may be a max of 30% of your base pay. Frequently, the finest way to enhance your revenues is to switch to a different firm and negotiate for a greater wage and benefit

Fascination About Transaction Advisory Services

You could enter company development, yet financial investment banking obtains harder at this stage since you'll be over-qualified for Analyst duties. Corporate money is still a choice. At this phase, you ought to just remain and make a run for a Partner-level function. If you desire to leave, perhaps transfer to a client and execute their assessments and due persistance in-house.The major problem is that due to the fact that: You generally require to sign her explanation up with another Large 4 view website team, such as audit, and job there for a couple of years and after that relocate into TS, work there for a few years and after that relocate into IB. And there's still no warranty of winning this IB function due to the fact that it depends on your region, clients, and the hiring market at the time.

Longer-term, there is additionally some danger of and since evaluating a company's historical financial information is not precisely brain surgery. Yes, human beings will always need to be entailed, yet with advanced modern technology, lower headcounts might potentially support client involvements. That claimed, the Transaction Services group defeats audit in regards to pay, job, and leave possibilities.

If you liked this short article, you might be interested in reading.

The 10-Second Trick For Transaction Advisory Services

Establish sophisticated financial structures that help in determining the actual market worth of a firm. Provide consultatory job in relationship to company evaluation to assist in bargaining and pricing structures. Discuss one of the most appropriate type of the deal and the sort of consideration to utilize (cash, stock, gain out, and others).

Create action strategies for threat and direct exposure that have been determined. Execute assimilation planning to establish the procedure, system, and organizational changes that may be needed after the offer. Make mathematical price quotes of combination expenses and benefits to examine the financial reasoning of combination. Establish guidelines for incorporating departments, modern technologies, and business procedures.

Examine the potential customer base, market verticals, and sales cycle. The functional due diligence offers vital insights into the performance of the firm to be acquired worrying risk analysis and worth production.

Report this wiki page